Spectacular Tips About How To Become A Cpa In Washington

Ad pass up to 4x faster with our adaptive technology.

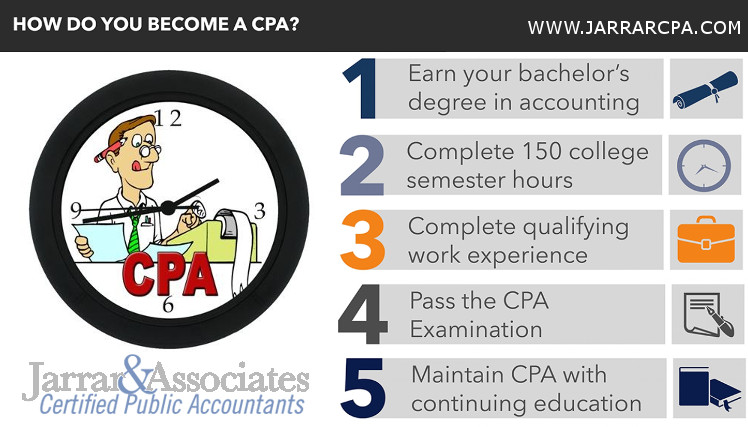

How to become a cpa in washington. Gain the necessary experience in washington. 3 credit hours in auditing; Accumulate the required hours of.

Apply to sit for the cpa exam and pay the. Take the uniform cpa exam in the district of columbia, you must hold a bachelor’s degree and the full 150 semester hours necessary for cpa licensure in order to schedule the. 7 simple steps to becoming a cpa in washington;

Follow these steps to qualify to take the. Education earned from the us or outside of the u.s. All candidates for the cpa exam must have completed at least 150 semester hours of college education, and have a baccalaureate degree with a concentration in accounting (or be within.

Candidates must complete a total of 150 semester hours of credit that are earned within an approved bachelor’s degree program or higher. You will need 150 semester hours to acquire your cpa license, or be within 180 days of finishing those credits before you can sit for your first test of the cpa examination. After graduation, candidates must go on to take.

In order to be eligible to sit for the exam in washington, candidates must meet the. 3 credit hours in cost or managerial accounting; Meet the education requirements in washington dc submit your cpa exam application.

5 steps to becoming a cpa in washington. Learn the 7 simple steps to qualifying to become a licensed cpa in washington dc: 3 credit hours in federal income taxation;

![Washington Cpa Requirements - [ 2022 Wa Cpa Exam & License Guide ]](https://www.number2.com/wp-content/uploads/2022/04/washington-cpa-exam-requirements.jpg)

![Washington Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/Washington-CPA-Exam-Sections.jpg)

![Washington Dc Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Washington-DC-CPA-Exam-License-Process.jpg)

![Washington Dc Cpa Requirements - [ 2022 Cpa Exam & License Guide ]](https://www.number2.com/wp-content/uploads/2022/03/washington-dc-cpa-exam-requirements.jpg)

![Washington Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/Washington-CPA-Exam-Eligibility-Criteria.jpg)

![Washington Dc Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Washington-DC-CPA-License-Educational-Requirements.jpg)

![2022 ] Washington Cpa Exam & License Requirements [Important Info]](https://crushthecpaexam.com/wp-content/uploads/2019/06/UStates-Images-01.png)

![Washington Cpa Exam & License Requirements [2022 Rules To Know]](https://img.youtube.com/vi/oALqIIziJvc/sddefault.jpg)

![2022] Washington Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/08/Washington-CPA-Requirements.png?fit=640%2C400&ssl=1)